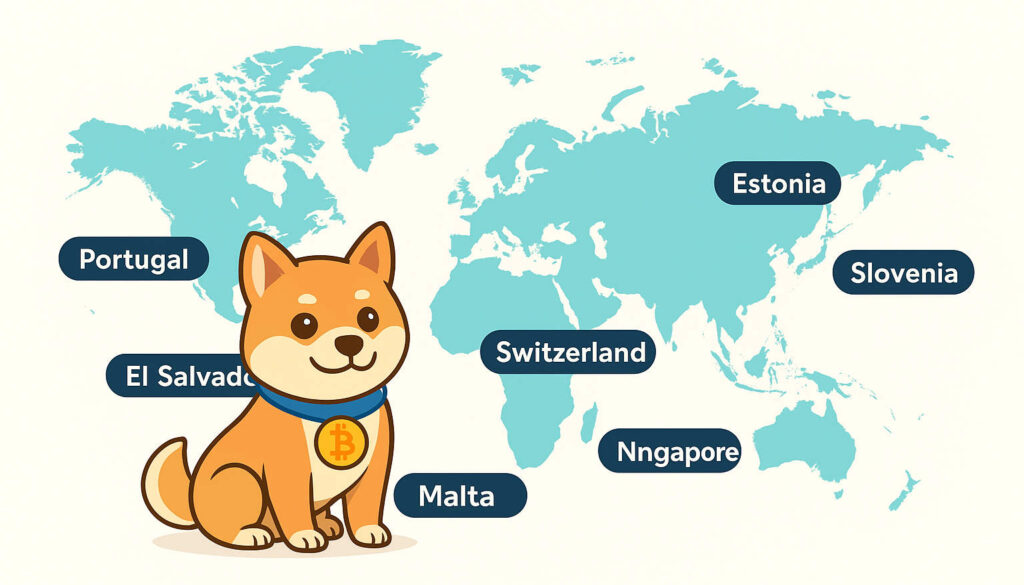

The world needs new global currency for transparent and to cross beyond borders. Therefore crypto continues to transform at a fast pace, pushing jurisdictions to establish digital and supportive regulations. Some nations have emerged as leaders, offering the strongest environments for individuals and companies to flourish in the digital asset space.

Countries that offer zero or low crypto taxes are preferred more because of the help they provide new companies looking to operate in their country. The regulations and compliance in different countries are SEC in US, MiCA in the EU,VARA in the United Arab Emirates and MAS in Singapore can help you clarify the regulations for that specific jurisdiction. Below are the Crypto friendly countries in 2026 that offers low taxes with developed banking infrastructure.

El Salvador

El Salvador made history by declaring Bitcoin legal tender. With 0% tax on foreign crypto income, it has launched the ambitious “Bitcoin City” project powered by geothermal energy. Bitcoin is legal tender with no capital gains

Singapore

Crypto is legal in Singapore, under the Payment Services Act, Known as MAS, The Monetary Authority of Singapore regulates the crypto currency as a digital asset, not a legal tender. maintains a zero capital gains tax regime. Crypto adoption is high, with 43% of young adults holding digital assets.

United Arab Emirates

The UAE especially Dubai offers a tax-free environment for personal and crypto income. Regulation is overseen by VARA, supporting more than 1,000 crypto companies in the DMCC free zone. The best crypto exchanges that are fully compliant with local regulations VARA and offer features for beginners and advanced users. Some of the Top choices generally include Binance, Coinbase and BitGet.

Germany

Germany treats cryptocurrency as private money, allowing 0% tax on assets held for over 12 months.

Switzerland

Switzerland’s famous “Crypto Valley” in Zug draws blockchain startups from around the world. While the country imposes no capital gains taxes, small canton-level wealth taxes may apply. Low taxes and highly developed banking infrastracture.

Estonia

Estonia taxes crypto only when necessary, creating flexibility for investors. Its well-known e-residency program supports remote business formation, and more than 55% of Baltic crypto startups originate there.

Slovenia

Slovenia imposes no tax on individual crypto gains and supports adoption with over 100 crypto-ready merchants in Ljubljana using tools like GoCrypto.

Georgia

Georgia charges no capital gains tax on crypto and benefits from low-cost energy, giving it one of the highest Bitcoin hash rates per capita worldwide.

Portugal

Portugal offers an attractive environment for crypto businesses, featuring 0% tax on individual gains and no VAT or capital gains tax. With more than 150 merchants in Lisbon accepting crypto, the country has become a recognized crypto hub.

Malta

Malta, the first EU country to implement a dedicated crypto framework, earned the label Blockchain Island. It exempts long-term capital gains and continues to host a strong crypto ecosystem.

Countries with High Adoption Rates

The countries showing high levels of Crypto adoption are India, United States, Vietnam, South Korea, Nigeria, Pakistan, Argentina and Turkey. These countries are known for favourable regulations with supportive tax policies and thriving blockchain eco systems, planning for smarter ecosystems for investors and businesses.